Value Added Tax (VAT) Invoice Template

Download the value added tax (VAT) invoice template to bill value added taxes on shipped goods. VAT refers to a tax schedule that taxes each purchaser in a supply chain, and each purchaser that’s not an end consumer may later deduct the VAT paid. Use these forms for transactions that require VAT calculations rather than sales tax.

VAT Invoice

How to Make in Adobe PDF and Microsoft Word

Step 1 – Download in Adobe PDF (.pdf) or Microsoft Word (.doc).

Step 2 – Fill in the top with the seller’s name and address, with the invoice number and date to the right. Include the registration numbers, phone number, and email address below this. Then enter the client’s name, contact name, and indicate whom to make payments payable to.

Step 3 – Table – Here, list each service provided with a brief description, the hours worked, and the hourly rate. Calculate the total due for each service and add the VAT tax rate to arrive at the grand total.

Step 4 – Indicate the payment terms at the bottom, such as the due date and other special instructions.

How to Make in Microsoft Excel

Step 1 – Download in Microsoft Excel (.xls).

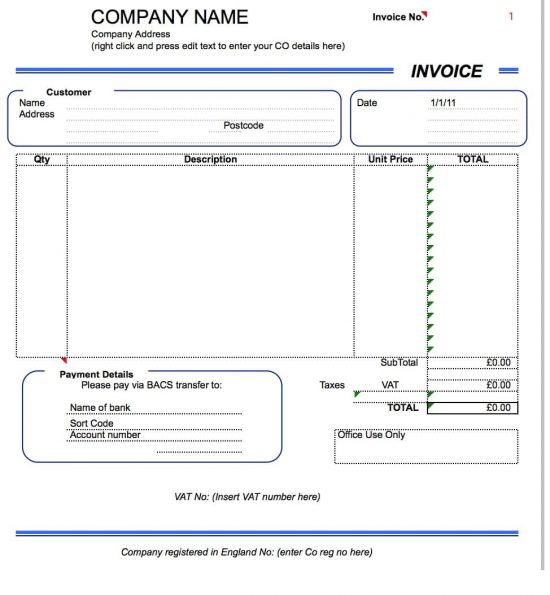

Step 2 – At the top, enter your company’s name, address, and the invoice number. Then below fill in the customer’s name, address, and the invoice date.

Step 3 – Table – For each type of good, enter a separate row indicating its quantity, description, and price per unit. Multiply the quantity by price for each to arrive at the subtotal. Enter the VAT rate and amount to reach the grand total the client owes.

Step 4 – Indicate where to make payment if needed, and include your VAT number at the bottom. Modify the company registration information at bottom as needed.